Portfolio Analysis

Published:

We create a portfolio of stocks from American markets, analyze their performance and try to acess the risk in future.

Building the porfolio

We will build a tech dominant portfolio to analyze including companies like Apple, Microsoft, Google etc.

import yfinance as yf

import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

# List of stock symbols

tech_stocks = ['AAPL', 'MSFT', 'AMZN', 'GOOGL', 'META']

# Set the date range for the historical data

start_date = '2020-08-01'

end_date = '2023-08-01'

# Download historical stock data for each stock

stocks = yf.download(tech_stocks, start_date, end_date)['Close']

[*********************100%%**********************] 5 of 5 completed

Portfolio construction

To assign the weight of each of the company stock we calculate the market capitalisation. To get the market value we need to know the last price of the security traded and the number of shares outstanding. yfinance gives the market cap directly.

For this, it is important to have a benchmark that can be used as a reference for the securities.

totalmp = 0

mcap=[]

for stock in tech_stocks:

# Create a Ticker object

# Create a Ticker object

ticker = yf.Ticker(stock)

# Fetch company information

company_info = ticker.info

# Get the market capitalization

market_cap = company_info.get('marketCap', None)

mcap.append(market_cap)

totalmp += market_cap

weights = [mc/totalmp for mc in mcap]

print(weights)

[0.3174813752091255, 0.2629812984283075, 0.1530503049106324, 0.18437709035962263, 0.08210993109231199]

Portfolio standard deviation

\[\sigma_{port} = \sqrt{w_{t}\Sigma w}\]\(\Sigma\) is covariance matrix and w’s are weights

# stock return

stocks_return = (stocks/stocks.shift(1))

# covariance of stocks

cov_matrix = stocks_return.cov()

# Annual portfolio covariance

cov_annual = cov_matrix * 252

# portfolio standard deviation

port_std = np.sqrt(np.dot(np.array(weights).T, np.dot(cov_annual, np.array(weights))))

print(f"portfolio standard deviation is {port_std*100:0.2f}%")

portfolio standard deviation is 30.35%

Portfolio returns

# get daily returns for each stock

stocks_return = stocks.pct_change()

# weighted portfolio return

weighted_returns_portfolio = stocks_return.mul(weights,axis = 1 )

# portfolio return

stocks_return[ 'Portfolio' ] = weighted_returns_portfolio.sum(axis = 1 )

stocks_return.head()

| AAPL | AMZN | GOOGL | META | MSFT | Portfolio | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2020-08-03 | NaN | NaN | NaN | NaN | NaN | 0.000000 |

| 2020-08-04 | 0.006678 | 0.008657 | -0.006380 | -0.008454 | -0.015009 | 0.000629 |

| 2020-08-05 | 0.003625 | 0.021091 | 0.003930 | -0.002842 | -0.001641 | 0.006640 |

| 2020-08-06 | 0.034889 | 0.006231 | 0.017484 | 0.064868 | 0.016014 | 0.028666 |

| 2020-08-07 | -0.024495 | -0.017842 | -0.004372 | 0.011912 | -0.017888 | -0.012410 |

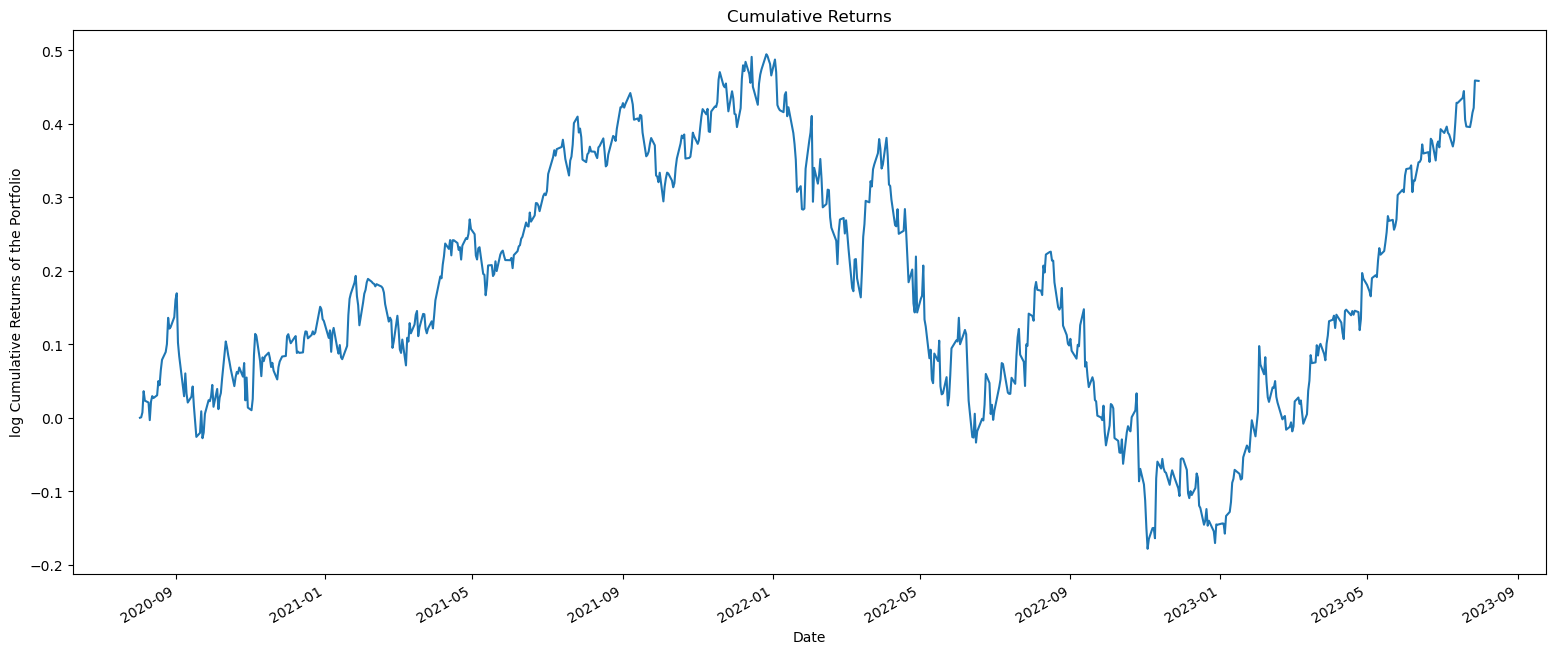

# cummulative returns

cum_returns_porfolio = ((1 + stocks_return[ 'Portfolio' ]).cumprod()-1)

fig,ax = plt.subplots(1,1,figsize = (19,8))

cum_returns_porfolio.plot(ax=ax)

ax.set_title('Cumulative Returns')

ax.set_ylabel('log Cumulative Returns of the Portfolio')

ax.set_xlabel('Date')

plt.show()

Capital asset Pricing model

Its major assumptions are that the offer of financial assets is equal to the demand of financial assets.

Only deals with systematic risk (market risk), that can’t be reduced.

Excess Return = Return − Risk Free Return

\[E(R_p) − RF = \beta_p(E(R_m) − RF)\]- \(E(R_p) − RF\) = The excess in the expected return of Portfolio P

- \(E(R_m) − RF\) = The excess expected return of market portfolio

- RF = Risk-Free Return

- \(\beta_p\) = Beta of the portfolio

Currently US3Y yeild is 4.54% and inflation is 3.3%

# real risk free rate = RFR - infaltion

infaltion = 3.3

RFR = 4.54

real_rf = RFR - infaltion

stocks_return[ 'RF Rate' ] = real_rf/100.0

# Excess return

stocks_return['excess'] = stocks_return['Portfolio'] - stocks_return[ 'RF Rate' ]

Beta

The measurement of the systematic risk is through the beta, which is a degree of sensitivity that includes the variation of an asset compared with an index that is used as a benchmark.

\[\beta_p = \frac{cov(R_{p},R_{m})}{\sigma_m}\]# To calculate beta

stocks_return['Market'] = yf.download( 'SPY',start_date,end_date)['Close']

stocks_return['Market']=stocks_return['Market'].pct_change()

stocks_return.head().dropna()

[*********************100%%**********************] 1 of 1 completed

| AAPL | AMZN | GOOGL | META | MSFT | Portfolio | RF Rate | excess | Market | |

|---|---|---|---|---|---|---|---|---|---|

| Date | |||||||||

| 2020-08-04 | 0.006678 | 0.008657 | -0.006380 | -0.008454 | -0.015009 | 0.000629 | 0.0124 | -0.011771 | 0.003863 |

| 2020-08-05 | 0.003625 | 0.021091 | 0.003930 | -0.002842 | -0.001641 | 0.006640 | 0.0124 | -0.005760 | 0.006211 |

| 2020-08-06 | 0.034889 | 0.006231 | 0.017484 | 0.064868 | 0.016014 | 0.028666 | 0.0124 | 0.016266 | 0.006685 |

| 2020-08-07 | -0.024495 | -0.017842 | -0.004372 | 0.011912 | -0.017888 | -0.012410 | 0.0124 | -0.024810 | 0.000718 |

# Exess return of the market

stocks_return['excess market'] = stocks_return['Market'] - stocks_return['RF Rate']

stocks_return.head().dropna()

| AAPL | AMZN | GOOGL | META | MSFT | Portfolio | RF Rate | excess | Market | excess market | |

|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||

| 2020-08-04 | 0.006678 | 0.008657 | -0.006380 | -0.008454 | -0.015009 | 0.000629 | 0.0124 | -0.011771 | 0.003863 | -0.008537 |

| 2020-08-05 | 0.003625 | 0.021091 | 0.003930 | -0.002842 | -0.001641 | 0.006640 | 0.0124 | -0.005760 | 0.006211 | -0.006189 |

| 2020-08-06 | 0.034889 | 0.006231 | 0.017484 | 0.064868 | 0.016014 | 0.028666 | 0.0124 | 0.016266 | 0.006685 | -0.005715 |

| 2020-08-07 | -0.024495 | -0.017842 | -0.004372 | 0.011912 | -0.017888 | -0.012410 | 0.0124 | -0.024810 | 0.000718 | -0.011682 |

# covariance matrix

covariance_matrix = stocks_return[[ 'excess', 'excess market' ]].cov()

covariance_matrix

| excess | excess market | |

|---|---|---|

| excess | 0.000365 | 0.000187 |

| excess market | 0.000187 | 0.000132 |

# covariane coeeficient

covariance_coefficient = covariance_matrix.iloc[0, 1]

# variance of market

variance_coefficient = stocks_return['excess market'].var()

# beta of the portfolio

beta = covariance_coefficient / variance_coefficient

beta

1.416897406000382

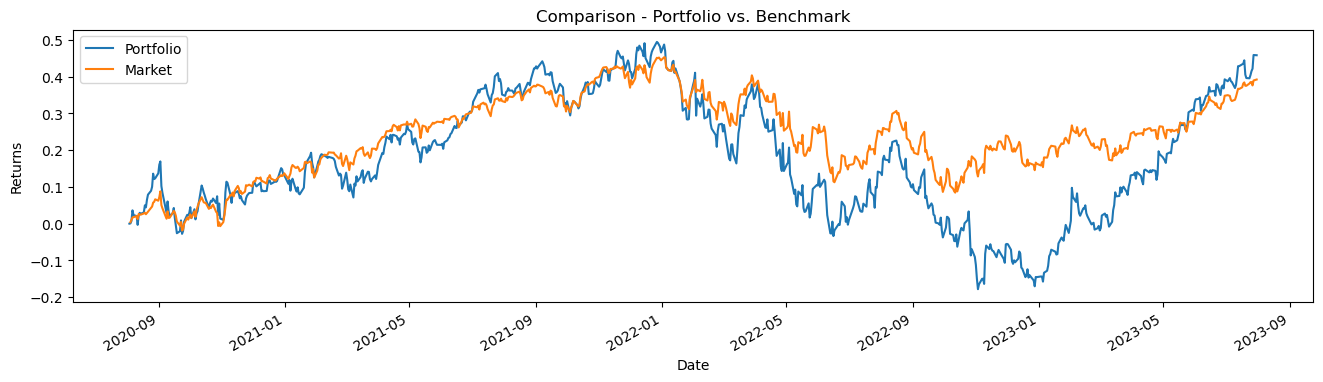

The beta demonstrates that the portfolio is more volatile than the market. The portfolio is 41% more volatile than the S&P 500. For every 1% of movement in the market there will be a 1.41% of rise or fall in the portfolio.

Sharpe Ratio

Higher ratio is better it is considered since the denominator is standard deviation or risk. It is used when comparing peers, for example in an exchange-traded fund (ETF)

\[Sharpe \ Ratio = \frac{R_p-R_f}{ \sigma_p}\]- \(R_p\) = returns of the portfolio

- \(R_f\) = risk-free rate

- \(\sigma_p\) = standard deviation of the portfolio excess returns.

# plot returns of porfolio and market

CumulativeReturns = ((1 + stocks_return[[ 'Portfolio','Market' ]]).cumprod()- 1 )

CumulativeReturns.plot(figsize = ( 16,4 ))

_ = plt.ylabel( 'Returns' )

_ = plt.title( 'Comparison - Portfolio vs. Benchmark' )

_ = plt.xlabel( 'Date' )

plt.show()

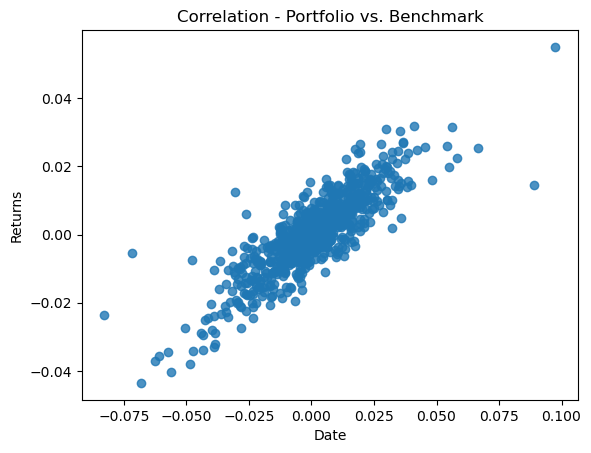

# plot scatter plot for correlation

plt.scatter(stocks_return[ 'Portfolio' ],stocks_return[ 'Market'],alpha = 0.80 );

_ = plt.ylabel( 'Returns' )

_ = plt.title( 'Correlation - Portfolio vs. Benchmark' )

_ = plt.xlabel( 'Date' )

# get the two columns in a dataframe

portfolio_benchmark = stocks_return[[ 'Portfolio','Market']].dropna()

# get correlation

portfolio_benchmark.corr()

| Portfolio | Market | |

|---|---|---|

| Portfolio | 1.000000 | 0.851744 |

| Market | 0.851744 | 1.000000 |

# get sharpe ratio

sharpe_ratio = ((stocks_return[ 'Portfolio' ].mean() - stocks_return[ 'RF Rate' ].mean()))/stocks_return['Portfolio' ].std()

print("Sharpe ratio is ",sharpe_ratio)

print("Sharpe ratio annual ",sharpe_ratio*np.sqrt(252))

Sharpe ratio is -0.6131452933469881

Sharpe ratio annual -9.73337978247526

SR is negative, indicates that mean return of the portfolio is smaller than the risk-free rate. Therefore the portfolio is not effective

Traynor ratio

Higher TR is a result of the portfolio management. When analyzing the Traynor Ratio, if it is negative, the portfolio has underperformed the risk-free rate.

\[Traynor Ratio = \frac{R_p - R_f}{\beta_p}\]- \(R_p\) = returns of the portfolio

- \(R_f\) = risk-free rate

- \(\beta_p\) = Beta of the portfolio

# covariance

covariance = stocks_return.cov() * 252

# covariance between market and portfolio

covariance_market_portfolio = covariance.at['Market','Portfolio']

# variance of market

market_variance = stocks_return[ 'Market'].var() * 252

# beta of the portfolio

portfolio_beta = covariance_market / market_variance

traynor_ratio = ((stocks_return['Portfolio'].mean() - stocks_return['RF Rate'].mean()))/portfolio_beta

traynor_ratio

-0.008268904314486599

TR is negative, which means that the port- folio is not performing better than the risk-free rate. Main difference between the Sharpe and the Traynor ratio is that it compares with the beta and not the volatility

Jensen’s measure

Measuring the relationship between the return of the portfolio in comparison with another portfolio return with the same risk, same reference market and under the same parameters.

\[\alpha = R_p - (R_f + \beta_p(R_m-R_p))\]# get covariance of between market and portfolio

annual_return = stocks_return

covariance = annual_return[[*tech_stocks,'Portfolio','Market']].cov()*252

covariance

| AAPL | MSFT | AMZN | GOOGL | META | Portfolio | Market | |

|---|---|---|---|---|---|---|---|

| AAPL | 0.093153 | 0.064348 | 0.074747 | 0.064086 | 0.081080 | 0.079273 | 0.044044 |

| MSFT | 0.064348 | 0.084440 | 0.076880 | 0.070369 | 0.082589 | 0.073578 | 0.042132 |

| AMZN | 0.074747 | 0.076880 | 0.142706 | 0.081007 | 0.110047 | 0.100261 | 0.049349 |

| GOOGL | 0.064086 | 0.070369 | 0.081007 | 0.102456 | 0.100217 | 0.081586 | 0.044204 |

| META | 0.081080 | 0.082589 | 0.110047 | 0.100217 | 0.232736 | 0.119713 | 0.054172 |

| Portfolio | 0.079273 | 0.073578 | 0.100261 | 0.081586 | 0.119713 | 0.092012 | 0.047174 |

| Market | 0.044044 | 0.042132 | 0.049349 | 0.044204 | 0.054172 | 0.047174 | 0.033294 |

# covariance market

covariance_market = covariance.at['Market','Portfolio']

# variance of market

market_variance = stocks_return[ 'Market' ].var() * 252

# beta of the portfolio

portfolio_beta = covariance_market/market_variance

# portfolio return

portfolio_return = stocks_return['Portfolio' ].mean()

# RFR

risk_free_rate = stocks_return['RF Rate'].mean()

# alpha

alpha = portfolio_return - (risk_free_rate + portfolio_beta*(portfolio_return - risk_free_rate))

alpha

0.004884448833019478