Time series analysis

Published:

We will discuss the time series analysis using finance data. The techniques like Moving Average (MA) , Autoregressive (AR) and Autoregressive Integrated Moving Average Model (ARIMA) will be dicussed. For modelling the time series we will be using the statsmodel library for the data acquired using Yahoo finance api.

Lets begin by importing the data of Microsoft for the years 2019-2021.

import yfinance as yfin

import numpy as np

import pandas as pd

import pandas_datareader.data as pdr

import statsmodels.api as sm

from statsmodels.tsa.seasonal import seasonal_decompose

from statsmodels.tsa.stattools import adfuller

from scipy import stats

import warnings

warnings.filterwarnings("ignore")

yfin.pdr_override()

# List of stock symbols

ticker = 'MSFT'

# Set the date range for the historical data

start_date = '2019-1-1'

end_date = '2021-1-1'

# Download historical stock data for each stock

stock = pdr.get_data_yahoo(ticker, start_date, end_date,interval='1d').Close

# choose data over 2 years

start_date = '2019-1-1'

end_date = '2021-1-1'

# get the data with 1d interval

stocks = pdr.get_data_yahoo(ticker, start_date, end_date,interval='1d').Close

stocks.dropna(inplace=True)

returns = stocks.pct_change()

returns.dropna(inplace=True)

stat_test = adfuller(returns.dropna())[0:2]

print(f"The test statistic and p-value of ADF test are {stat_test}")

if stat_test[1] < 0.05:

print("The data is stationary")

else:

print("The data is not stationary")

# split the data into train and test

split = int(len(returns.values) * 0.90)

price_train = stocks.iloc[:split+1]

price_test = stocks.iloc[split:]

return_train = returns.iloc[:split]

return_test = returns.iloc[split:]

print(return_test.shape,return_train.shape,price_test.shape,price_train.shape,stock.shape)

[*********************100%%**********************] 1 of 1 completed

[*********************100%%**********************] 1 of 1 completed

The test statistic and p-value of ADF test are (-7.212097179922102, 2.2211435488651752e-10)

The data is stationary

(51,) (453,) (52,) (454,) (505,)

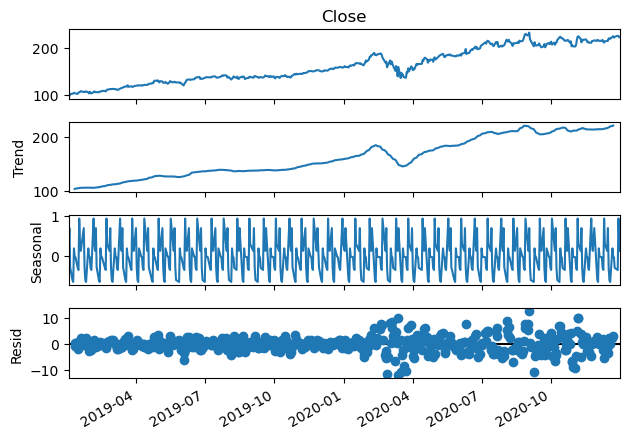

Lets quickly use the statsmodel to decompise the trend and seasonality in the data.

# Plot the components of a time series by

# seasonal_decompose function from statsmodels

import matplotlib.pyplot as plt

seasonal_decompose(stock, period=12).plot()

plt.gcf().autofmt_xdate()

plt.show()

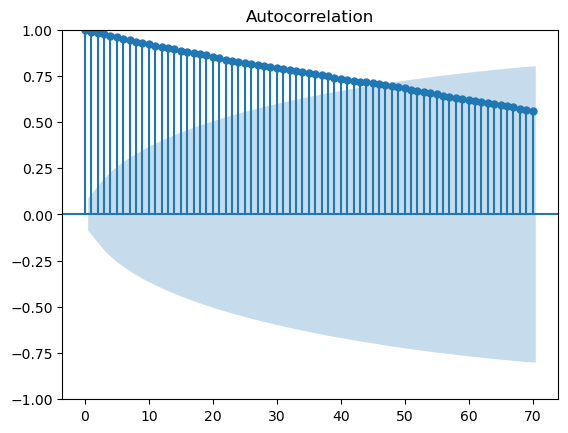

ACF and PCF

Auto-correlation functions (ACF) show the correlation between the same series with different lags. With h being the lag:

\[ρ(h) = \frac{Cov(X_t , X_{t−h} )}{Var(X_t )}\]The coefficients help in deciding the q in MA(q) models.

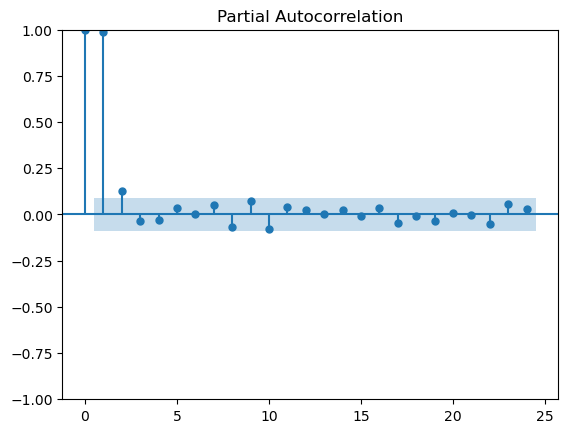

Partial ACF (PACF) gives information on correlation between current value of a time series and its lagged values controlling for the other correlations.

\[ρ(h) = \frac{Cov(X_t ,X_{t−h} |X_{t−1} ,X_{t−2} ...X_{t−h−1})}{ \sqrt{Var(X_t |X_{t−1} ,X_{t−2} ,...,X_{t−h−1} )Var(X_{t−h} |X_{t−1} ,X_{t−2} ,...,X_{t−h−1} )}}\]The coefficients help in deciding the p in AR(p) models.

sm.graphics.tsa.plot_acf(stock,lags=70)

plt.show()

It shows that there is strong dependence between the current value and lagged values of stock data as the coefficients of autocorrelation decay slowly.

sm.graphics.tsa.plot_pacf(stock, lags=24)

plt.show()

Lines above the confidence intervals are considered significant. We see the model with lag of 2 coefficient is enough to model the variations.

Time Series modeling

Moving Average (MA)

Moving average can be considered as smoothing model as it tends to take into account the lag values of residual.

For \(\alpha \ne 0\), MA(q) can be written as:

\[X_t = \epsilon_t + \alpha_1 \epsilon_{t−1} + \alpha_2 \epsilon_{t−2} ... + \alpha_q \epsilon_{t−q}\]

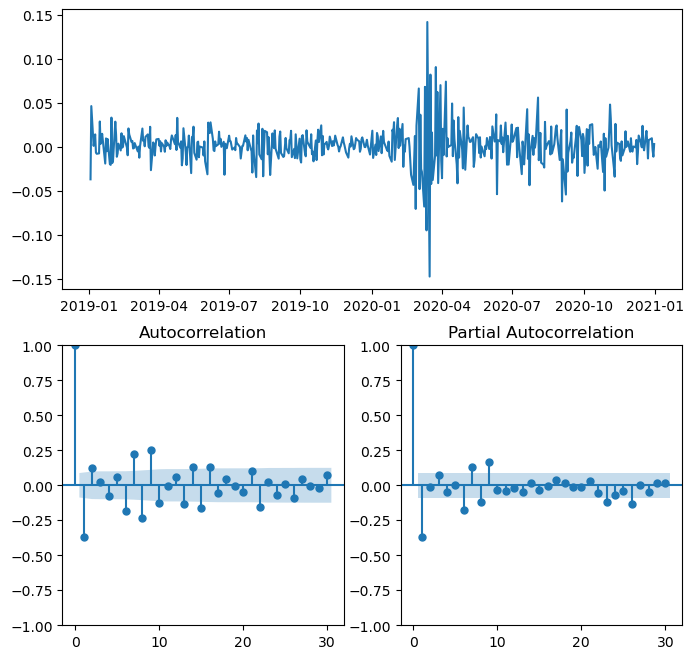

def ts_plots(data,lags):

mosaic = """

AA

BC

"""

fig = plt.figure(figsize=(8,8))

ax = fig.subplot_mosaic(mosaic)

ax['A'].plot(data)

sm.graphics.tsa.plot_acf(returns.dropna(),ax=ax['B'],lags=lags)

sm.graphics.tsa.plot_pacf(returns.dropna(),ax=ax['C'],lags=lags)

fig.subplots_adjust()

ts_plots(returns,lags=30)

plt.show()

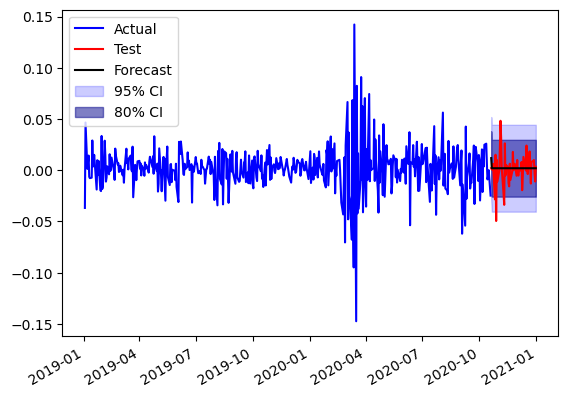

Peaks at 1 in ACF, we choose them order for MA i.e. MA(1) Model

from statsmodels.tsa.arima.model import ARIMA

modelMA = ARIMA(return_train, order=(0, 0, 1)).fit()

forecast = modelMA.get_forecast(steps=len(return_test))

conf_int95 = forecast.conf_int(alpha=0.05)

conf_int80 = forecast.conf_int(alpha=0.2)

fig,ax = plt.subplots()

ax.plot(return_train.index,return_train.values,color='b',label='Actual')

ax.plot(return_test.index,return_test.values,color='r',label='Test')

ax.plot(return_test.index,forecast.predicted_mean,color='k',label='Forecast')

ax.fill_between(return_test.index,conf_int95['lower Close'],conf_int95['upper Close'],alpha=0.2,color='b',label='95% CI')

ax.fill_between(return_test.index,conf_int80['lower Close'],conf_int80['upper Close'],alpha=0.5,color='darkblue',label='80% CI')

ax.legend(loc=2)

plt.gcf().autofmt_xdate()

# inspect residuals

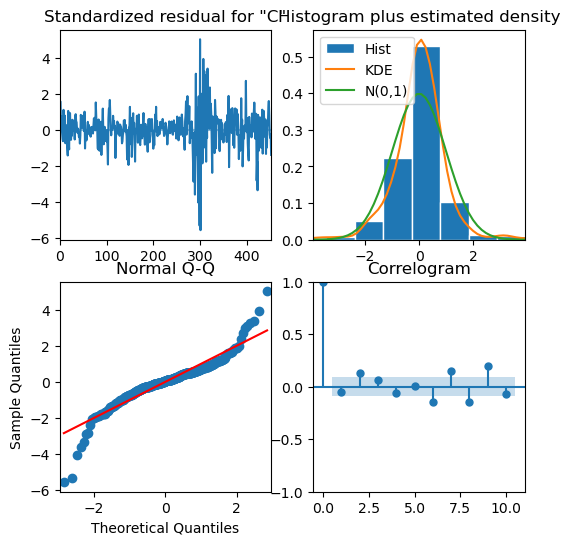

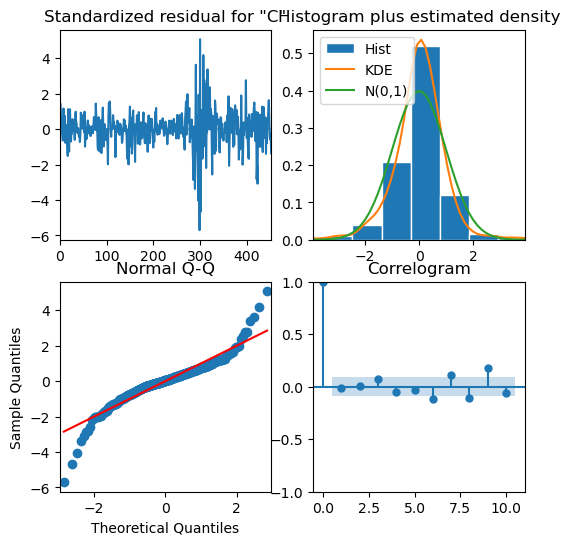

modelMA.plot_diagnostics(figsize=(6,6))

plt.show()

Residuals are white noise therefore, good fit

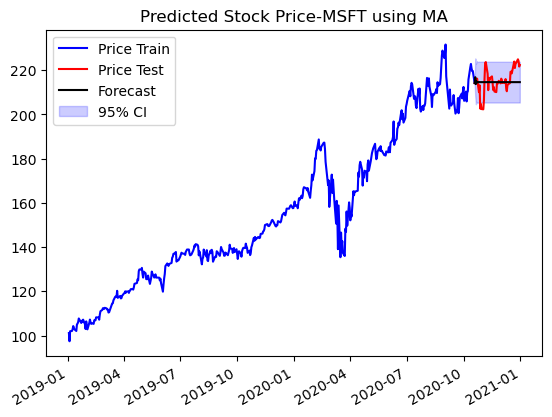

Transform back to prices

# use 95% confidence interval from above to return price forcasts and confidence intervals

pf=[]

pf.append(price_train[-1])

confd = []

confd.append(price_train[-1])

confu = []

confu.append(price_train[-1])

for ret,dn,up in zip(forecast.predicted_mean.values,conf_int95['lower Close'].values,conf_int95['upper Close'].values):

new_price = price_train[-1] * (1 + ret)

confu.append(price_train[-1] * (1 + up))

confd.append(price_train[-1] * (1 + dn))

pf.append(new_price)

fig,ax = plt.subplots()

ax.plot(price_train.index,price_train.values,color='b',label='Price Train')

ax.plot(price_test.index,price_test.values,color='r',label='Price Test')

ax.plot(price_test.index,pf,color='k',label='Forecast')

ax.fill_between(price_test.index,confd,confu,alpha=0.2,color='b',label='95% CI')

ax.set_title(f'Predicted Stock Price-{ticker} using MA')

ax.legend()

plt.gcf().autofmt_xdate()

conf_int80['lower Close'].iloc[i]

-0.025608780730429798

sm.stats.durbin_watson(modelMA.resid.values)

2.021053921541334

Short-term moving average tends to more reactive to daily activity and long MA captures the global trend, But still the model is not able to capture the trends

Autoregressive Model

Idea is the current value is regressed over its own lag values in this model. Forcast the current value of time series \(X_{t}\):

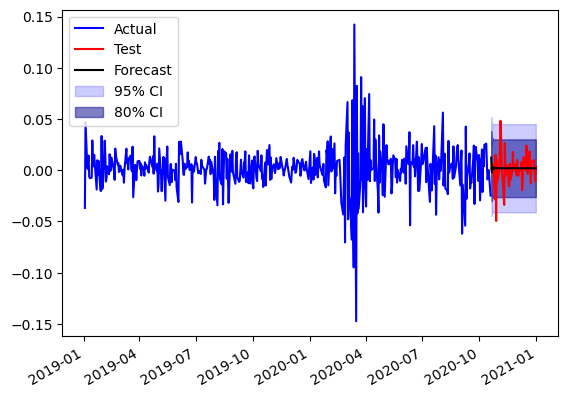

\[X_t = c + \alpha_1 X_{t−1} + \alpha_2 X_{t−2} ... + \alpha_p X_{t−p} + \epsilon_t\]We see a peak in the PCAF of data at p=1

from statsmodels.tsa.arima.model import ARIMA

modelMA = ARIMA(return_train, order=(1, 0, 0)).fit()

forecast = modelMA.get_forecast(steps=len(return_test))

conf_int95 = forecast.conf_int(alpha=0.05)

conf_int80 = forecast.conf_int(alpha=0.2)

fig,ax = plt.subplots()

ax.plot(return_train.index,return_train.values,color='b',label='Actual')

ax.plot(return_test.index,return_test.values,color='r',label='Test')

ax.plot(return_test.index,forecast.predicted_mean,color='k',label='Forecast')

ax.fill_between(return_test.index,conf_int95['lower Close'],conf_int95['upper Close'],alpha=0.2,color='b',label='95% CI')

ax.fill_between(return_test.index,conf_int80['lower Close'],conf_int80['upper Close'],alpha=0.5,color='darkblue',label='80% CI')

ax.legend(loc=2)

plt.gcf().autofmt_xdate()

# inspect residuals

modelMA.plot_diagnostics(figsize=(6,6))

plt.show()

# use 95% confidence interval from above to return price forcasts and confidence intervals

pf=[]

pf.append(price_train[-1])

confd = []

confd.append(price_train[-1])

confu = []

confu.append(price_train[-1])

for ret,dn,up in zip(forecast.predicted_mean.values,conf_int95['lower Close'].values,conf_int95['upper Close'].values):

new_price = price_train[-1] * (1 + ret)

confu.append(price_train[-1] * (1 + up))

confd.append(price_train[-1] * (1 + dn))

pf.append(new_price)

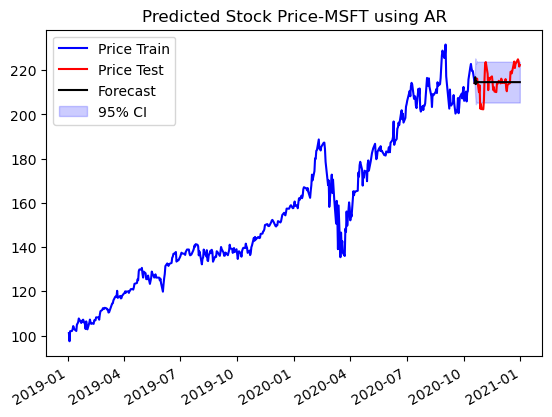

fig,ax = plt.subplots()

ax.plot(price_train.index,price_train.values,color='b',label='Price Train')

ax.plot(price_test.index,price_test.values,color='r',label='Price Test')

ax.plot(price_test.index,pf,color='k',label='Forecast')

ax.fill_between(price_test.index,confd,confu,alpha=0.2,color='b',label='95% CI')

ax.set_title(f'Predicted Stock Price-{ticker} using AR')

ax.legend()

plt.gcf().autofmt_xdate()

AR(1) model does a similar job to MA(1) at predicting the stock trend but still is not able to predict it to good affect. Both models are similar to trivial model with last price forcasting.

ARIMA Models

ARIMA models are a combination of three key components: AutoRegressive (AR), Integrated (I), and Moving Average (MA). The advantage of intergration parameter is that is non-stationary data is used it can make it stationary by defining the integration parameter.

Three parameters are to be defined p (dicussed above for AR), q (dicussed for MA) and d (control for level difference). d=1 is makes the model ARMA which is a limiting case of ARIMA (p,1,q) models but is also a good model given by:

\[Xt = \alpha_1 dX_{t−1} + \alpha_2 dX_{t−2} ... + \alpha_p dX_{t−p} + \epsilon_t + \beta_1 d\epsilon_{t−1} + \beta_2 d\epsilon_{t−2} ... + \beta_q d\epsilon_{t−q}\]Pros

- ARIMA allows us to work with raw data without considering if it is stationary.

- It performs well with high-frequent data. It is less sensitive to the fluctuation in the data compared to other models.

Cons

- ARIMA might fail in capturing seasonality.

- It work better with a long series and short-term (daily, hourly) data.

- As no automatic updating occurs in ARIMA, no structural break during the analysis period should be observed.

- Having no adjustment in the ARIMA process leads to instability.

Choosing the parameters from for the ARIMA model. I choose the range 0-10 for the p and q and 0-3 for d. Selection of the parameters for the model is made using Akaike Information Criterion (AIC). The parameters resulting in minimum value of AIC are selected.

\[AIC=2k−2ln(L)\]Where:

- AIC is the Akaike Information Criterion.

- k is the number of parameters in the model.

- ln(L) is the natural logarithm of the likelihood of the model.

stat_test = adfuller(returns.dropna())[0:2]

print(f"The test statistic and p-value of ADF test are {stat_test}")

if stat_test[1] < 0.05:

print("The returns are stationary")

else:

print("The returns are not stationary")

The test statistic and p-value of ADF test are (-7.212097179922102, 2.2211435488651752e-10)

The returns are stationary

Since returns are stationary so set d=1

from pmdarima import auto_arima

import warnings

warnings.filterwarnings("ignore")

model = auto_arima(price_train, start_p=0, start_q=0,

test='adf',

max_p=12, max_q=12,

d=1,

seasonal=True,

start_P=0,

D=1,

trace=True,

error_action='ignore',

suppress_warnings=True,

stepwise=True)

Performing stepwise search to minimize aic

ARIMA(0,1,0)(0,0,0)[0] intercept : AIC=2443.312, Time=0.03 sec

ARIMA(1,1,0)(0,0,0)[0] intercept : AIC=2385.968, Time=0.21 sec

ARIMA(0,1,1)(0,0,0)[0] intercept : AIC=2394.636, Time=0.13 sec

ARIMA(0,1,0)(0,0,0)[0] : AIC=2443.519, Time=0.03 sec

ARIMA(2,1,0)(0,0,0)[0] intercept : AIC=2387.962, Time=0.14 sec

ARIMA(1,1,1)(0,0,0)[0] intercept : AIC=2387.964, Time=0.12 sec

ARIMA(2,1,1)(0,0,0)[0] intercept : AIC=2389.416, Time=0.62 sec

ARIMA(1,1,0)(0,0,0)[0] : AIC=2388.723, Time=0.03 sec

Best model: ARIMA(1,1,0)(0,0,0)[0] intercept

Total fit time: 1.302 seconds

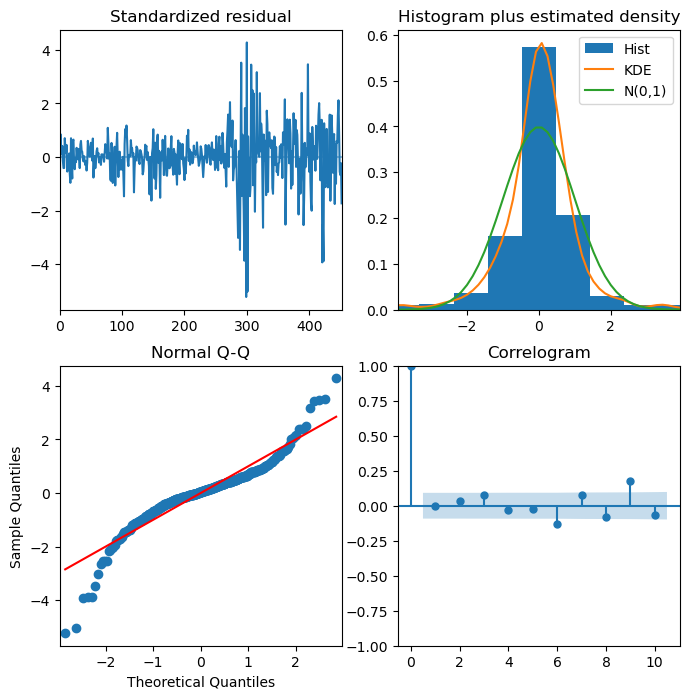

# inspect residuals

model.plot_diagnostics(figsize=(8,8))

plt.show()

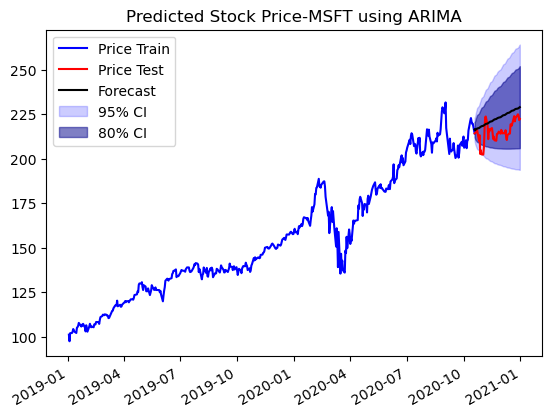

y_forec95, conf_int95 = model.predict(len(price_test),return_conf_int=True,alpha=0.05)

y_forec80, conf_int80 = model.predict(len(price_test),return_conf_int=True,alpha=0.2)

fig,ax = plt.subplots()

ax.plot(price_train.index,price_train.values,color='b',label='Price Train')

ax.plot(price_test.index,price_test.values,color='r',label='Price Test')

ax.plot(price_test.index,y_forec95,color='k',label='Forecast')

ax.fill_between(price_test.index,conf_int95[:,0],conf_int95[:,1],alpha=0.2,color='b',label='95% CI')

ax.fill_between(price_test.index,conf_int80[:,0],conf_int80[:,1],alpha=0.5,color='darkblue',label='80% CI')

ax.set_title(f'Predicted Stock Price-{ticker} using ARIMA')

ax.legend(loc=2)

plt.gcf().autofmt_xdate()

The ARIMA model is able to get capture the trend of the price movement and does a better job at predicting prices. The prices lie within the 80% confidence interval.

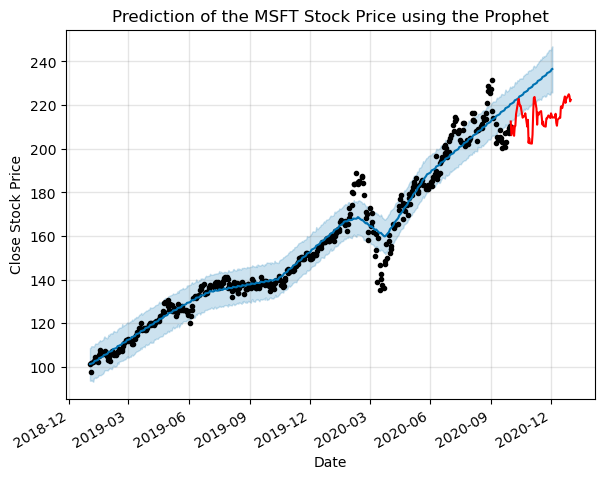

Prophet

from prophet import Prophet

alldat = stocks.to_frame().reset_index()

alldat.rename(columns={'Date':'ds','Close':'y'},inplace=True)

# # Specify the split date

# split_date = pd.to_datetime('2020-10-01')

# Split the DataFrame into two based on the split date

train_df = alldat[alldat['ds'] < split_date]

test_df = alldat[alldat['ds'] >= split_date]

m = Prophet(daily_seasonality = True) # the Prophet class (model)

m.fit(train_df)

19:49:16 - cmdstanpy - INFO - Chain [1] start processing

19:49:16 - cmdstanpy - INFO - Chain [1] done processing

<prophet.forecaster.Prophet at 0x14743a500b90>

future = m.make_future_dataframe(periods=64) #we need to specify the number of days in future

fig,ax = plt.subplots()

prediction = m.predict(future)

m.plot(prediction,ax=ax)

ax.set_title(f"Prediction of the {ticker} Stock Price using the Prophet")

ax.set_xlabel("Date")

ax.set_ylabel("Close Stock Price")

ax.plot(test_df['ds'],test_df['y'],color='r')

plt.gcf().autofmt_xdate()

plt.show()

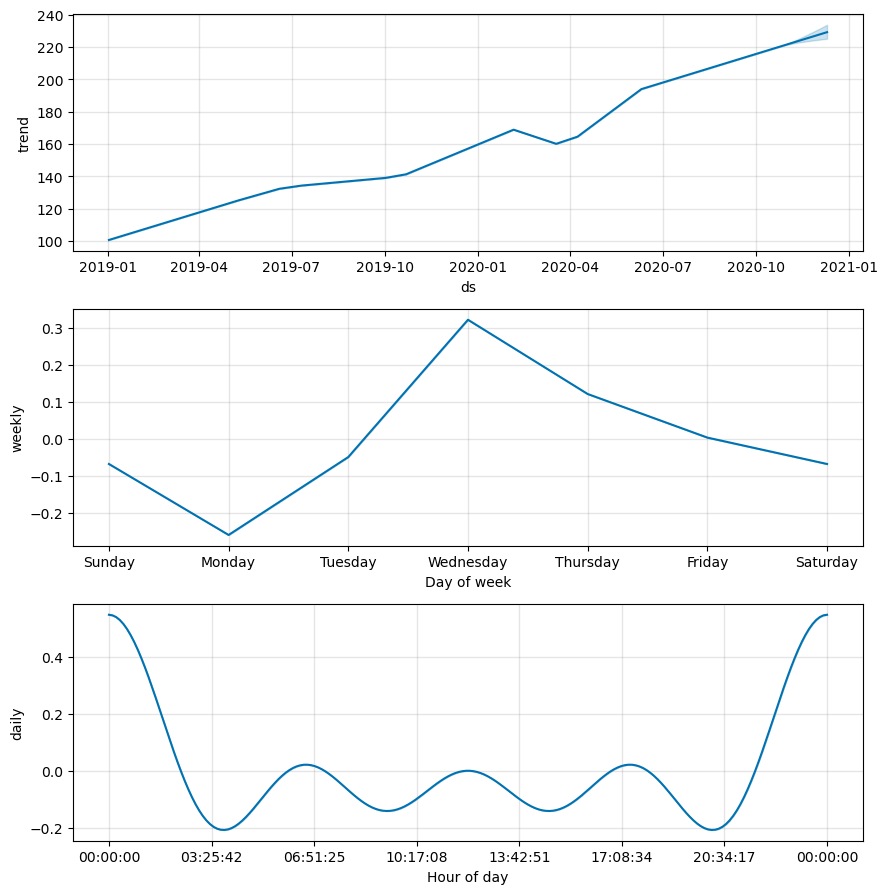

m.plot_components(prediction)

plt.show()

Prophet does not seem to do a good job for predicting the stock future movements out of the box